In today’s digital economy, a seamless and secure payment process is crucial for any business. For developers seeking greater control over their payment flow and looking to reduce transaction fees, building a custom payment gateway offers a powerful solution. This comprehensive integration tutorial provides a step-by-step guide to constructing your own payment gateway, covering key aspects from design and security to implementation and maintenance. Whether you are building an e-commerce platform, a subscription service, or any other online business, understanding the intricacies of payment gateway integration is essential for success. This tutorial will equip you with the knowledge and practical skills needed to navigate the complexities of online payments and empower you to create a tailored solution that meets your specific business needs.

This tutorial will delve into the technical details of building your own payment gateway, addressing critical considerations such as security protocols, PCI compliance, and fraud prevention. We will explore various payment gateway integration methods, discussing the advantages and disadvantages of each approach. By the end of this guide, you will have a solid understanding of how to build, integrate, and maintain a robust and secure payment gateway, ultimately enhancing the customer experience and optimizing your business’s financial operations. Join us as we embark on this comprehensive journey into the world of payment gateway development.

Understanding Payment Gateways and Their Importance

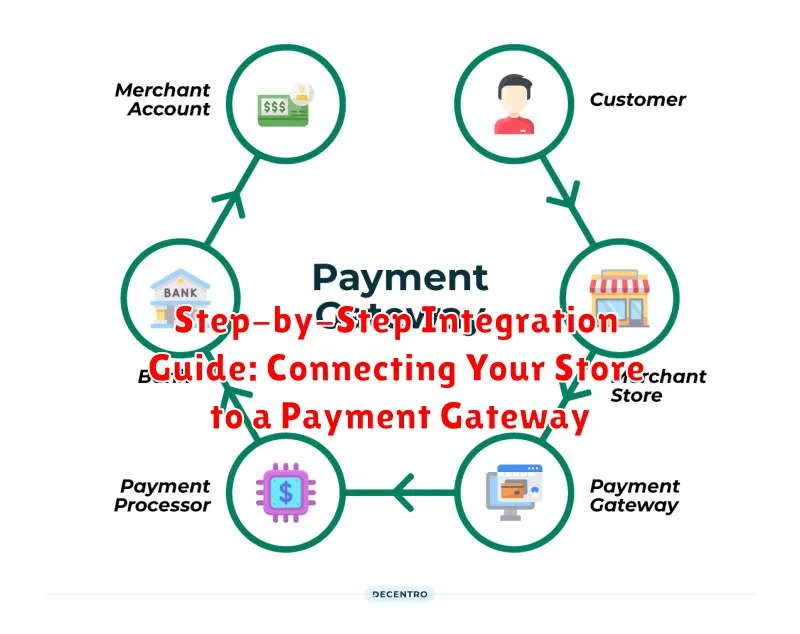

A payment gateway acts as a crucial intermediary between your online store and financial institutions, facilitating secure and efficient processing of electronic payments. Think of it as a virtual point-of-sale system for online transactions.

Why are payment gateways important? They authorize transactions, ensure funds transfer, and manage sensitive customer data. Without a payment gateway, accepting online payments would be complex, time-consuming, and significantly less secure.

Key Functions of a Payment Gateway:

- Encryption: Secures sensitive data like credit card numbers.

- Authorization: Verifies the customer’s ability to pay.

- Capture: Transfers funds from the customer’s account.

- Settlement: Deposits funds into the merchant’s account.

Choosing the Right Payment Gateway for Your Business

Selecting the right payment gateway is a critical decision that impacts your business’s financial operations and customer experience. Several factors must be considered to ensure a seamless and secure transaction process.

Transaction Fees are a primary concern. Different gateways have different fee structures, including per-transaction fees, monthly fees, and chargeback fees. Carefully analyze these costs and how they align with your sales volume and average transaction value.

Supported Payment Methods are crucial for catering to your target audience. Consider whether you need to accept major credit cards, debit cards, digital wallets (like Apple Pay or Google Pay), or other payment options relevant to your customer base.

Security Features are paramount. Choose a gateway that complies with Payment Card Industry Data Security Standard (PCI DSS) regulations and employs robust fraud prevention tools to protect both your business and your customers.

Integration Capabilities must align with your existing e-commerce platform and other business systems. Ensure the gateway offers seamless integration with your shopping cart software and other backend applications.

Customer Support is essential for troubleshooting technical issues and addressing any payment processing challenges. Look for a provider that offers reliable and responsive customer support channels.

Step-by-Step Integration Guide: Connecting Your Store to a Payment Gateway

Integrating a payment gateway involves connecting your online store’s backend to the chosen provider’s API. This enables seamless transaction processing between your store and the payment processor.

Step 1: Account Creation and Setup. Begin by creating a developer account with your chosen payment gateway provider. Obtain the necessary API keys and credentials for authentication.

Step 2: SDK or API Integration. Most providers offer SDKs (Software Development Kits) in various programming languages. Utilizing an SDK simplifies the integration process. Alternatively, direct API integration is possible. Choose the method that best suits your technical capabilities.

Step 3: Frontend Integration. Implement the necessary frontend code to capture customer payment details securely. This typically involves integrating a payment form within your checkout process. Ensure the form transmits data securely to the payment gateway.

Step 4: Backend Processing. Your backend system should handle communication with the payment gateway API. This includes sending transaction details, processing responses, and managing order statuses.

Testing and Troubleshooting Your Payment Gateway Integration

Thorough testing is crucial after integrating a payment gateway. This ensures all transactions are processed securely and reliably. Start with test transactions using small amounts and various payment methods supported by your gateway.

Test Cases:

- Successful transactions

- Failed transactions (e.g., incorrect card details, insufficient funds)

- Refunds

- Edge cases (e.g., international transactions, recurring billing)

Troubleshooting Common Issues:

Encountering issues is normal. Keep detailed logs of transactions and error messages. Refer to your payment gateway’s documentation for specific error codes. Common issues include incorrect API credentials, network connectivity problems, and data format mismatches. Using a debugger can help pinpoint the source of errors in your code. If issues persist, contact your payment gateway’s support team for assistance.

Security Best Practices for Payment Gateway Integrations

Implementing robust security measures is paramount when integrating a payment gateway. Protecting sensitive customer data is not only crucial for maintaining customer trust but also for complying with industry regulations like PCI DSS.

Encryption is fundamental. Utilize strong encryption protocols like TLS 1.3 for all communications between your system and the payment gateway. Never store sensitive cardholder data like the full magnetic stripe data or CVV after the transaction is processed. Tokenization is a highly recommended practice, replacing sensitive data with unique, non-sensitive tokens.

Regular security audits and penetration testing are vital for identifying and mitigating vulnerabilities. Implement strong access control measures, restricting access to payment gateway credentials and sensitive data on a need-to-know basis. Two-factor authentication adds an extra layer of protection to prevent unauthorized access.

Common Payment Gateway Integration Errors and How to Fix Them

Integrating a payment gateway can be complex, and errors are common. Addressing these issues promptly is crucial for a smooth user experience.

Incorrect API Credentials

One frequent issue is using incorrect API keys or secret keys. Double-check your credentials and ensure they are entered correctly in your configuration. Refer to your payment gateway provider’s documentation for the correct key formats.

Data Format Errors

Sending data in the wrong format can lead to transaction failures. Carefully review the required data fields and formats specified by your payment gateway. Ensure your application sends data that conforms to these specifications, including data types, lengths, and required fields.

Insufficient Logging

Debugging integration issues is challenging without adequate logging. Implement comprehensive logging to track requests, responses, and errors. This will help identify the source of problems quickly.

Ignoring Error Codes

Payment gateways provide error codes that indicate the reason for transaction failures. Do not ignore these codes. Use them to diagnose and fix the underlying issue. Consult the payment gateway’s documentation for a complete list of error codes and their meanings.

Keeping Your Payment Gateway Integration Up-to-Date

Maintaining a current payment gateway integration is crucial for security and functionality. Regular updates ensure compatibility with evolving industry standards and protect against emerging threats.

Scheduled Reviews: Implement a regular review schedule, at least quarterly, to check for updates from your payment gateway provider. These updates often include security patches, performance improvements, and new features.

Testing Updates: Before deploying any updates to your live system, thoroughly test them in a staging environment. This allows you to identify and address any potential conflicts or issues before they impact your customers.

API Versioning: Pay close attention to API versioning. Providers often release new API versions with enhanced functionalities. Plan and execute migrations to newer versions to leverage these improvements and ensure long-term support.