In today’s fast-paced digital world, a streamlined and secure online checkout process is crucial for any successful e-commerce business. Customers demand a fast, safe, and efficient way to purchase goods and services online. This article provides valuable tips for optimizing your online checkout, enabling you to enhance the customer experience while simultaneously boosting conversions and minimizing abandoned carts. By implementing these strategies, you can ensure a faster and safer checkout experience, leading to greater customer satisfaction and increased sales. Learn how to create a streamlined purchase process that prioritizes both speed and security.

From minimizing required fields and offering diverse payment options to implementing robust security measures and optimizing for mobile devices, this guide covers essential steps to create a truly seamless checkout experience. Discover practical tips to achieve a faster and safer online checkout, addressing concerns around security, speed, and ease of use. Understanding the importance of a streamlined purchase process can be the key to unlocking greater online success. By following these tips, you can significantly improve your customers’ online checkout experience and make the purchase process both faster and safer.

Optimizing Your Checkout Page for Speed and Conversions

A streamlined checkout process is crucial for minimizing cart abandonment and maximizing conversions. Page load speed is a primary factor. A slow checkout page can frustrate customers and lead them to abandon their purchase. Optimize images, minimize HTTP requests, and leverage browser caching to improve load times.

Minimize distractions on your checkout page. Remove unnecessary elements, such as sidebars or promotional banners, that can divert the customer’s attention. Keep the focus solely on completing the purchase.

Progress indicators are a valuable tool. Clearly display the steps involved in the checkout process, showing customers where they are in the sequence and how much is left to complete. This provides transparency and encourages completion.

Form optimization is key. Streamline form fields, requesting only essential information. Consider using autofill functionality and input validation to reduce friction and improve the user experience.

Prioritizing Security Measures for a Safe Checkout Experience

Security is paramount for online transactions. Customers need to feel confident that their sensitive data is protected. Implementing robust security measures is crucial for building trust and preventing fraud.

HTTPS is fundamental. Ensure your entire checkout process is encrypted using HTTPS. This secures the communication channel between the customer’s browser and your server, protecting data like credit card numbers and personal information from interception.

PCI DSS compliance is essential. This standard sets requirements for handling credit card information, ensuring data security and reducing the risk of breaches. Compliance signals to customers that their payment information is handled securely.

Two-factor authentication (2FA) adds another layer of security. Require customers to verify their identity through a second channel, like a code sent to their phone or email, to further protect their accounts from unauthorized access.

Offering Multiple Payment Options for Customer Convenience

Providing a variety of payment methods is crucial for a positive checkout experience. Customers have diverse preferences and offering limited options can lead to abandoned carts. Supporting major credit cards (Visa, Mastercard, American Express, Discover) is essential.

Consider incorporating alternative payment gateways like PayPal, Apple Pay, and Google Pay for added convenience. These options often streamline the process, allowing customers to bypass manual form filling.

Furthermore, depending on your target market, offering buy now, pay later options or other financing solutions can be beneficial. These services can increase purchasing power and encourage larger transactions. Be sure to clearly display accepted payment methods on your checkout page for easy identification.

Simplifying Form Filling with Autofill and Guest Checkout

A streamlined checkout process hinges on minimizing friction for the customer. Autofill functionality dramatically reduces the time and effort required to complete forms. By allowing browsers to automatically populate fields with saved information like addresses and payment details, customers can breeze through checkout. Ensure your forms are compatible with common autofill standards to facilitate this.

Forcing account creation can deter potential customers. Offering a guest checkout option caters to those who prefer a quick, no-commitment purchase. This removes the barrier of mandatory registration, enabling immediate transactions. While encouraging account creation offers long-term benefits, providing a guest checkout option respects customer preferences and often leads to higher conversion rates.

Building Trust with Security Badges and Clear Policies

Trust is paramount in online transactions. Displaying recognizable security badges from reputable companies like Norton or McAfee can instantly reassure customers that their information is safe. Place these badges prominently near payment information fields or in the footer.

Clearly articulated privacy and security policies are crucial for establishing customer confidence. Explain how customer data is collected, used, and protected. A concise and easy-to-understand policy demonstrates transparency and builds trust.

Contact information should be readily available. Offering a phone number, email address, or live chat option gives customers a direct line of communication if they have any questions or concerns regarding security.

Using Strong Passwords and Two-Factor Authentication

Strong passwords are the first line of defense against unauthorized access to your online accounts. A strong password should be at least 12 characters long and include a mix of uppercase and lowercase letters, numbers, and symbols. Avoid using easily guessable information like your name, birthday, or common words.

Two-factor authentication (2FA) adds an extra layer of security. Even if your password is compromised, a hacker will still need a second factor to access your account. Common second factors include a code sent to your phone via text message, a code generated by an authenticator app, or biometric verification like a fingerprint scan. Enable 2FA on all accounts that offer it.

By implementing these measures, you significantly reduce the risk of unauthorized access and keep your online transactions secure.

Protecting Against Fraud with Address Verification and CVV

Address Verification Service (AVS) and the Card Verification Value (CVV) are crucial security features that help protect against fraudulent transactions when shopping online. AVS compares the billing address you provide during checkout with the address your card issuer has on file. Any discrepancies can trigger a decline, preventing unauthorized use if your card is stolen.

The CVV is a three- or four-digit number located on your credit or debit card that provides an extra layer of security. Because it’s not embedded in the magnetic stripe or chip, it’s harder for fraudsters to obtain even if they have your card number. By requiring the CVV during checkout, merchants can verify that you have the physical card in your possession.

While these measures significantly improve security, always be vigilant. Review your credit card statements regularly and report any suspicious activity immediately to your financial institution.

Ensuring PCI DSS Compliance for Secure Payment Processing

PCI DSS (Payment Card Industry Data Security Standard) compliance is crucial for any business that processes card payments. It’s a set of security standards designed to protect cardholder data and minimize the risk of fraud. By adhering to these standards, businesses can build trust with customers and avoid hefty penalties for non-compliance.

Key aspects of PCI DSS compliance include protecting stored cardholder data, maintaining secure networks, and regularly testing security systems. This involves encrypting sensitive data, using strong firewalls, and implementing intrusion detection systems. It’s not merely a technical checklist, but a comprehensive approach to safeguarding payment information throughout its lifecycle.

For online businesses, PCI DSS compliance often involves working with compliant third-party payment processors. Choosing a processor that adheres to these standards significantly reduces your burden and ensures your customers’ payment information is handled securely. Confirm your payment gateway’s compliance status and understand how they help you meet the requirements.

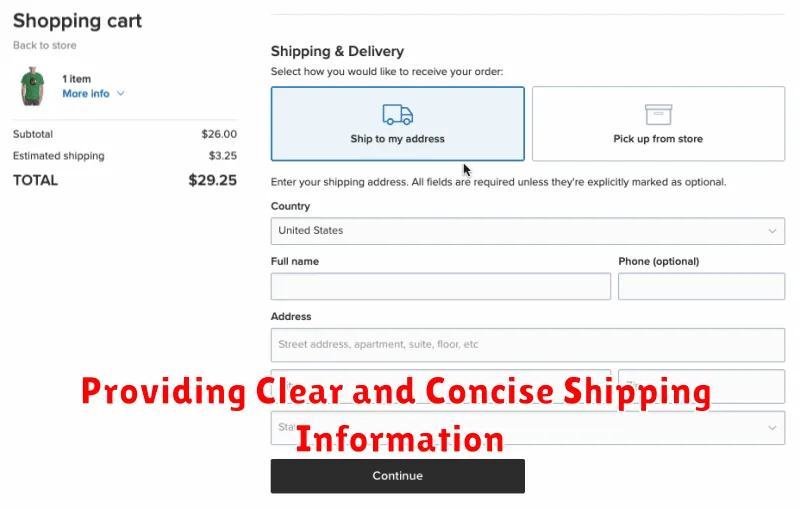

Providing Clear and Concise Shipping Information

Accurate shipping information is crucial for a smooth and timely delivery. Inputting incorrect or incomplete details can lead to delays, lost packages, and unnecessary frustration. Double-check all information before submitting your order.

Pay close attention to the following:

- Full Name: Provide the exact name as it appears on your official identification to avoid any confusion with delivery services.

- Complete Address: Include street number, apartment or suite number (if applicable), city, state, and zip code. Verify the address is correct and up-to-date.

- Contact Information: Provide a valid phone number and email address. This allows the delivery service to contact you regarding your delivery if needed.

- Delivery Instructions (Optional): If you have specific delivery instructions, such as leaving the package at a back door or with a neighbor, clearly note them during checkout.

Taking a few extra moments to ensure accurate shipping details contributes significantly to a positive online shopping experience.