In today’s digital marketplace, offering a seamless and secure checkout experience is paramount to business success. Understanding and implementing the most popular online payment methods is crucial for attracting and retaining customers. This article will delve into the nuances of various payment gateways, exploring the advantages and disadvantages of each to help you make informed decisions for your business. We’ll cover everything from the ubiquitous credit card processing and digital wallets like PayPal and Apple Pay to the rising popularity of Buy Now, Pay Later services and other emerging online payment solutions. Choosing the right combination of payment methods can significantly impact your conversion rates and overall profitability.

Navigating the complex landscape of online payment systems can be challenging. From security concerns to transaction fees and integration complexities, there are numerous factors to consider. This guide will decode the most prevalent online payment methods, providing you with a comprehensive understanding of credit card payments, mobile payments, and alternative payment options. By the end of this article, you will be equipped to select the optimal payment gateway solutions for your business, optimizing your checkout process and enhancing the customer experience. We’ll explore the benefits and drawbacks of each method, helping you strategize and select the best online payment methods for your specific business needs.

Understanding the Landscape of Digital Payments

The digital payments landscape is constantly evolving, offering businesses a wide array of options for accepting payments online. Understanding this landscape is crucial for choosing the right payment methods for your business and target audience. Factors such as security, convenience, and cost play a significant role in this decision-making process.

Several key trends are shaping the future of digital payments. The increasing use of mobile devices has fueled the growth of mobile wallets and in-app payments. Furthermore, the demand for seamless and frictionless checkout experiences is driving innovation in areas like one-click payments and biometric authentication.

Staying informed about these trends and understanding the preferences of your customers will allow your business to adapt and thrive in the competitive world of e-commerce.

Credit and Debit Cards: The Classic Choice

Credit and debit cards remain a cornerstone of online transactions. Their widespread acceptance and established infrastructure make them a reliable payment option for businesses.

Credit cards allow customers to borrow funds for purchases, offering flexibility and convenience. Processing involves card networks like Visa and Mastercard, facilitating the transfer of funds from the customer’s credit account to the merchant’s account.

Debit cards, conversely, draw funds directly from the customer’s bank account. This real-time deduction often appeals to budget-conscious shoppers and minimizes the risk of overspending. Debit card transactions typically involve lower processing fees for merchants compared to credit cards.

Security measures like EMV chips and two-factor authentication enhance the safety of card transactions, providing an added layer of protection against fraud for both businesses and consumers.

Offering credit and debit card payment options is essential for businesses seeking to cater to a broad customer base and maintain a competitive edge in the online marketplace.

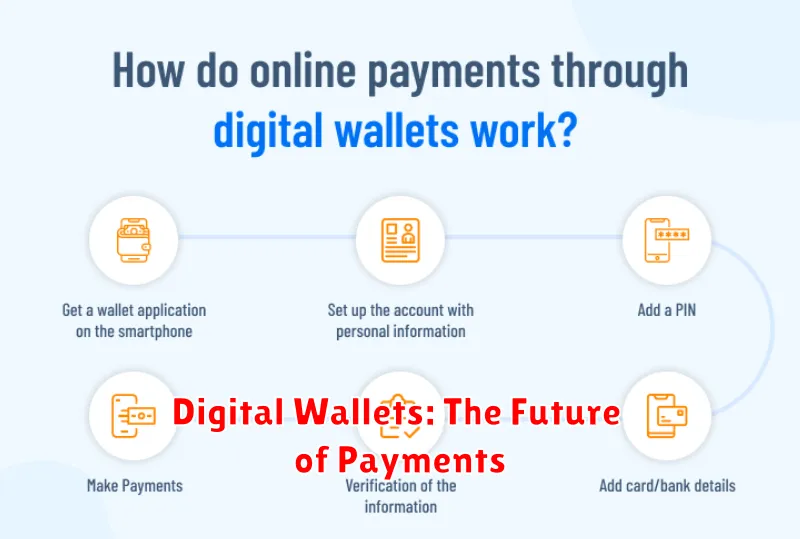

Digital Wallets: The Future of Payments

Digital wallets represent a significant shift in how consumers make purchases, offering a streamlined and secure alternative to traditional payment methods. These wallets store users’ payment information digitally, allowing for contactless transactions in physical stores and expedited checkouts online.

Key players in the digital wallet space include Apple Pay, Google Pay, Samsung Pay, and PayPal. These platforms leverage near-field communication (NFC) technology for in-person transactions, enabling customers to simply tap their devices on compatible terminals.

For e-commerce businesses, integrating digital wallets offers several advantages. They reduce friction at checkout, leading to potentially higher conversion rates. The enhanced security features, such as tokenization and biometric authentication, can also minimize fraud risk.

The growing popularity of digital wallets signals their importance for businesses seeking to cater to the evolving preferences of their customer base. By offering this payment option, businesses can enhance customer experience and position themselves for continued growth in the digital marketplace.

The Rise of Buy Now, Pay Later (BNPL)

Buy Now, Pay Later (BNPL) has emerged as a disruptive force in the payments landscape, offering consumers increased flexibility at the point of sale. BNPL services allow customers to split their purchases into smaller, interest-free installments, typically paid over a few weeks or months. This payment method has gained significant traction, particularly among younger demographics.

Key benefits for businesses adopting BNPL include increased average order values and improved conversion rates. By reducing the upfront cost barrier, BNPL can encourage customers to complete purchases they might otherwise abandon. However, businesses must also consider the associated fees charged by BNPL providers.

Regulation of BNPL is an evolving area, with increasing focus on consumer protection and responsible lending practices. Businesses considering integrating BNPL should stay informed about the latest regulatory developments to ensure compliance.

Mobile Payments: On-the-Go Convenience

Mobile payments leverage smartphones and other mobile devices to facilitate transactions, offering a seamless and convenient checkout experience for customers. These payments utilize various technologies, including near-field communication (NFC) and QR codes.

NFC-based payments, like Apple Pay and Google Pay, allow customers to simply tap their device against a compatible terminal to complete a purchase. This technology transmits payment information wirelessly and securely.

QR code payments involve customers scanning a merchant-displayed QR code with their device’s camera. This action triggers the payment process, often through a linked digital wallet or banking app.

Mobile payments offer benefits for businesses, including streamlined checkout processes, reduced reliance on physical card readers, and increased customer satisfaction due to the speed and convenience they provide. They also tap into a growing market of consumers who prefer using their mobile devices for transactions.

Bank Transfers: A Secure Alternative

Bank transfers offer a secure and reliable method for online payments. Customers initiate transfers directly from their bank accounts to your business account. This eliminates the need for intermediaries, reducing potential security vulnerabilities and processing fees.

Advantages of bank transfers include enhanced security, lower transaction fees compared to card payments, and the ability to handle larger transaction amounts. They also offer increased transparency, as transactions are clearly recorded within bank statements.

However, bank transfers can be slower than other payment methods. Processing times can vary depending on the banks involved and can sometimes take several business days. This can impact the immediacy of order fulfillment. Additionally, they lack the built-in buyer protection mechanisms offered by some credit cards.

While bank transfers offer a robust security profile, they may not be suitable for businesses requiring instant payment confirmation or catering to customers who prefer quicker checkout experiences.

Cryptocurrency Payments: Exploring the Potential

Cryptocurrencies offer a novel approach to online transactions, bypassing traditional financial institutions. Decentralization and transparency are key features, with transactions recorded on a public, immutable ledger known as the blockchain.

Accepting cryptocurrencies can broaden your customer base, particularly among tech-savvy individuals and those seeking alternative payment options. Bitcoin and Ethereum are among the most widely accepted cryptocurrencies.

Volatility is a significant consideration. Cryptocurrency values can fluctuate dramatically, impacting the value of transactions. Businesses must carefully assess the risks associated with price swings.

Transaction fees can vary significantly depending on the cryptocurrency and network congestion. While some cryptocurrencies offer lower fees than traditional payment methods, others can be more expensive.

Choosing the Right Payment Gateway for Your Needs

Selecting the right payment gateway is crucial for a smooth and secure online transaction process. A payment gateway acts as the intermediary between your business and your customers, securely processing payments and ensuring funds are transferred efficiently.

Several factors should influence your choice. Transaction fees are a primary concern. Different gateways charge varying rates per transaction, and understanding these costs is essential for managing your profit margins.

Security features are paramount. Look for gateways that offer robust fraud protection, data encryption, and compliance with PCI DSS standards. This safeguards both your business and your customers’ sensitive information.

Integration with your existing platform is another key consideration. The payment gateway should seamlessly integrate with your e-commerce platform or website for a streamlined checkout experience.

Finally, consider the supported payment methods. Ensure the gateway supports the payment options preferred by your target audience, whether that includes credit cards, debit cards, or digital wallets.

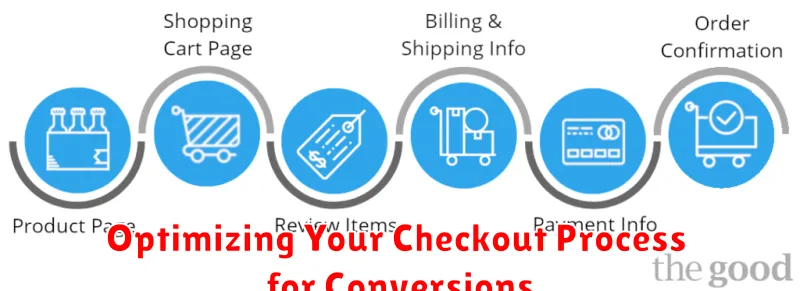

Optimizing Your Checkout Process for Conversions

A streamlined and user-friendly checkout process is crucial for maximizing conversions. Minimize the steps required to complete a purchase. A lengthy or complicated checkout can lead to cart abandonment.

Clearly display all costs upfront, including shipping, taxes, and any other fees. Hidden costs revealed at the last minute erode customer trust and can deter purchases.

Offer guest checkout options. Forcing customers to create an account can be a barrier to completing a purchase. While account creation has benefits, allow customers to checkout without one.

Mobile optimization is essential. Ensure your checkout process is responsive and functions flawlessly on all devices. A poor mobile experience can significantly impact conversion rates.

Provide multiple payment options to cater to different customer preferences. This flexibility can significantly improve the checkout experience.